The Working Families Tax Credit is Finally Here!

Along with our coalition partners, we at MomsRising are spreading some good news! Over 400,000 Washington households will be eligible for the Working Families Tax Credit starting in February 2023.

Are you curious about the program? Want to help spread the word? You’re reading the right blog post!

What is the Working Families Tax Credit?

Washington made history in 2021 when the legislature passed and funded the Working Families Tax Credit, a first-of-its-kind policy for the state that will put millions of dollars back into the pockets of families. Eligible households can receive up to $1,200 per year starting this month. This is just the start to make sure every Washingtonian can put food on the table, pay for emergencies, and go to sleep with peace of mind.

Don’t miss out on your payment - ask about the Working Families Tax Credit when you do your taxes. This payment is not a loan, and you can use it however you like. Undocumented immigrants and mixed status families are eligible for the Working Families Tax Credit. Your information is safe, and free assistance is available to help you apply. Check your eligibility and apply for the credit at workingfamiliescredit.wa.gov!

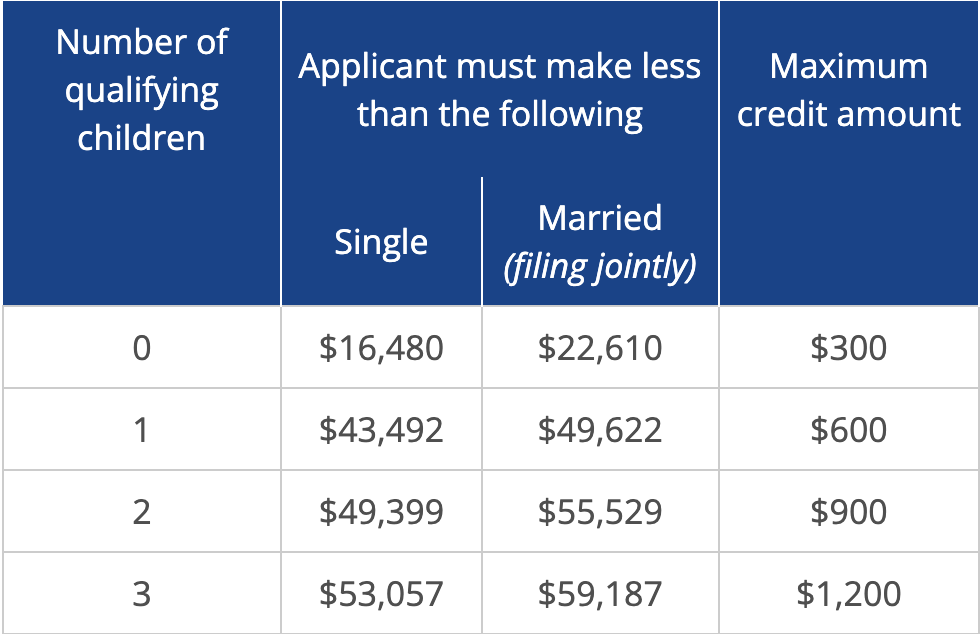

Working Families Tax Credit Eligibility Table:

(Please note, the income limits will increase slightly each year).

source: https://workingfamiliescredit.wa.gov/eligibility#block-whoiseligibleforataxcredit

Do you want to help spread the word and stay engaged with all that is happening with the WFTC?

Helping spread the word is critical in the first year of this program, so we can make sure every eligible household receives their cash. There are many ways you can do this!

Want to spread the word right from your computer or phone?

The WFTC has a Facebook page with overview videos you can share on your socials WFTC Facebook Page.

Want posters or flyers to hang around your community or share with friends and family?

Check out our flyers and posters in various languages too!

What’s next for this policy?

Advocates, community members, and organizers (like you!) across the state, including us here at MomsRising, are working to expand on the WFTC. We want to make it even more equitable. During this legislative session, we are championing House Bill 1075/Senate Bill 5249 - a bill that would expand the Working Families Tax Credit to include low-income, working young people and seniors trying to make ends meet. The current age range for childless workers limits the lifesaving WFTC cash to those who are 25-65 years old.

This expansion would:

-

Expand the age range so that all filers 18 and older can access the WFTC

-

Reach more young, working adults and seniors, increasing covered households by nearly 50%.

- Add 210,000 households. Currently, the WFTC is estimated to have 420,000+ households

Have questions?:

Check out our FAQ page.

If you don’t see an answer to your question, email us at wainfo@momsrising.org

Curious how you can stay up to date on the WFTC?

Sign up for updates at the bottom of this page.

Follow the WFTC Coalition on Facebook and on our coalition page.

And lastly…

You can join us in urging our lawmakers to sign on in support of expanding this critical legislation HERE!

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!