Head Smacker: House Spends Billions on Business Tax Breaks, Leaves Out Low-Income People

Check out this post by the Coalition on Human Needs' Senior Policy Writer Lecia Imbery:

Last week was a big week for corporate tax breaks in the House of Representatives. Between Thursday and Friday, the full House passed a series of tax breaks for businesses at a cost of more than $93 billion over 10 years. The bills would make these breaks permanent parts of the tax code. Also on Thursday, the House Ways and Means Committee, headed by Chairman Paul Ryan (R-WI), passed two additional permanent tax breaks costing $224 billion over 10 years. None of these tax breaks would be paid for by closing other tax loopholes, raising revenue in some other way, or cutting spending, meaning the cost of all of these bills would add over $317 billion to our nation’s deficit.

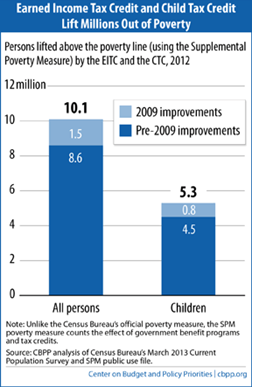

Unfortunately, last week wasn’t such a big week for low-income families. Not only did the House vote for business tax breaks while investments in human needs programs continue to shrink, they left the fate of tax credits for low-income workers and their families blowing in the wind. If improvements made in 2009 to the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) are allowed to expire in 2017 – and so far the House has made no move to prevent it – 16 million children and adults will fall into poverty or become more deeply poor.

Some of the tax breaks passed by the House have merit, like one that provides incentives for businesses to donate their food inventory to charities. However, all of the charitable incentives passed last week make up only 5 percent of the total tax breaks passed by the Ways and Means Committee. Passing these breaks that do good opens the door for – but doesn’t justify – hundreds of billions of dollars of breaks that add to the deficit and leave low-income folks behind. The charitable breaks could easily be paid for by reducing tax breaks that do nothing to promote shared prosperity.

In addition to the general head-smacking nature of all this, the Center on Budget and Policy Priorities points out that Chairman Ryan has said he supports expanding the EITC for workers without dependent children and paying for it by making changes that would reduce errors and overpayment within the EITC. Yet he voted for permanent business tax breaks with a much higher error rate without paying for them.

As we noted in a previous Head Smacker, the House last year passed a package of tax breaks mostly for businesses that cost over $500 billion over 10 years and wasn’t paid for. Meanwhile, they refused to pass measures to help low- and middle-income families, like an extension of unemployment benefits, with the excuse that they weren’t paid for. Some say the reason for these corporate tax breaks is to create jobs, but the evidence isn’t on their side.

Where these tax breaks will go from here is unclear. For now, the Senate has refrained from taking up any of these breaks in the hopes of moving larger tax reform legislation. For its part, the White House said that it would veto the bills the House passed on Thursday and Friday, both because they not paid for and because they leave out the EITC and CTC.

Choosing corporate tax breaks over those for low-income families is unacceptable. Tax credits for low-income families not only have a demonstrated track record of encouraging work and improving children’s education and earnings in adulthood, they’re the right thing to do now – for the recipients and for our nation. Why the House can’t see this is a real Head Smacker.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!