Health insurance isn’t always first on a young adult’s mind. But money often is. So parents, what happens when you explain to your grown kid that having health coverage can be key to protecting their purchasing power, in addition to health? Many listen and enroll.

Let Your Kid Know It’s in Their Financial Interest

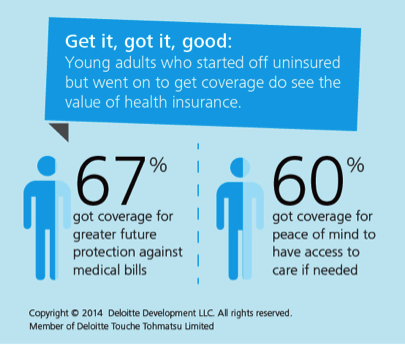

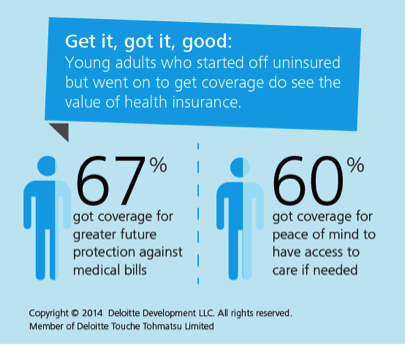

A new report, Young Adults and Health Insurance: Not Invincible – But Perhaps Convincible, released this week by the Deloitte Center for Health Solutions makes this clear. In early April, Deloitte surveyed young adults, aged 19 to 34, – both those who did and did not sign up for health coverage – to get their views about health insurance. Survey results reveal that most young adults (67 percent) who got health coverage did so because they realized insurance could provide protection against future medical bills.

Peace of Mind is Important to Stress, Too

Almost as many respondents (60 percent) who became insured also indicated they enjoy having the “peace of mind” that they can get health care if needed.

On the day they were signing up for coverage, young adults who enrolled may have been thinking about more than just the pizza money they needed for dinner that evening. Sixty-eight percent of young adults, aged 18 to 34, who bought a plan on HealthCare.gov chose a silver-level plan—a plan that is more expensive up front than a bronze-level plan, but that also covers more of the cost of health care services when you use them. In selecting more comprehensive coverage, the group that became insured may have been thinking about how to save money in the long run, too.

Let Young Adults Know About Their Coverage Options

As it turns out, pocketbook pain was on the mind of many young adults who remained uninsured, too. Deloitte found that 66 percent of young adults who did not enroll in any insurance coverage during the initial marketplace enrollment period said they didn’t think they could afford health insurance. But, when the entire group was asked about their awareness of various insurance provisions of the Affordable Care Act (like insurance subsidies and expanded eligibility for Medicaid), many (45 percent and 47 percent, respectively) said they were unaware that these provisions existed. This group could have been missing out on the various types of financial help potentially available to them!

According to a Young Invincibles’ estimate based on 2012 Census data, of the roughly 19 million uninsured young adults age 18 to 34, up to 13.7 million could be eligible for free or discounted health insurance coverage through Medicaid or the marketplaces. That means the majority of young, uninsured adults could qualify for low-cost care.

To put these potential discounts in context, the Department of Health and Human Services (HHS) reported last month that of everyone who enrolled in a plan through HealthCare.gov with tax credits, 69 percent paid a monthly premium of $100 or less, and 46 percent got covered for $50 or less per month after tax credits.

Reach Out – You’re One of Your Kid’s Most Trusted Sources on This Topic

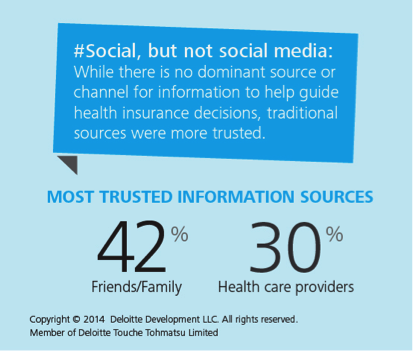

Communicating information about financial help that’s available to young adults who don’t think they can afford coverage is critical, and many in this age group are counting on family and friends to help. Deloitte’s survey found that friends and family members are among young people’s top sources for trusted information on health insurance:

As parents, spouses, family members, and friends, we have a role to play in talking to the people in our lives about getting covered. And, encouraging the young people in your lives to learn how affordable health insurance can be today could be even easier with the subsidy calculator that Kaiser Family Foundation created! While there are three months until the next Open Enrollment period starts on November 15, 2014, young adults experiencing a life-changing event (like getting married, moving, having a baby) may qualify to sign up for affordable care now.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!