Fact of the Week: Four in ten Americans would struggle with unexpected expense of $400

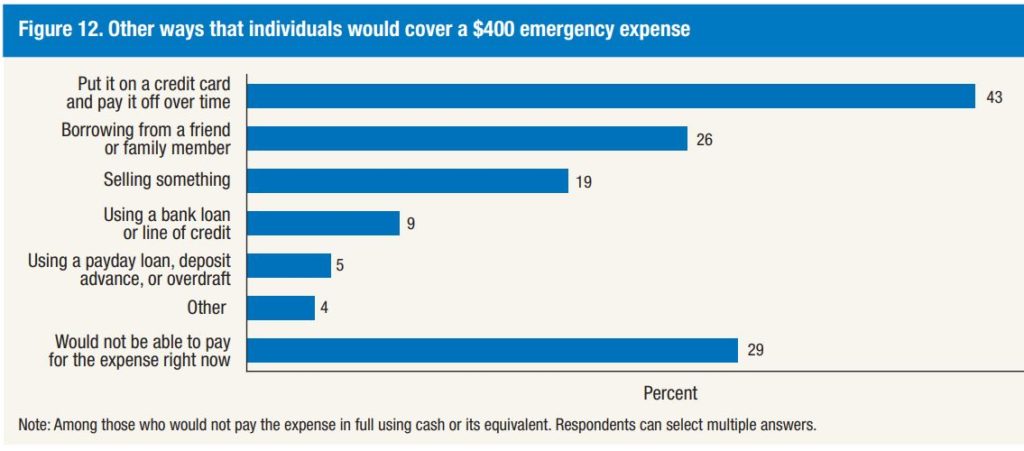

Four in 10 adults either could not cover an emergency expense costing $400 or would have to borrow money or sell something to cover it, according to a recent report from the Federal Reserve System. The picture is bleaker for people with a high school degree or less: 54 percent of these respondents said they would struggle with such an expense. Across every education level, fewer African American and Hispanic households would be able to handle a financial setback than White households.

The Report on the Economic Well-Being of U.S. Households in 2017 is a survey of the financial and economic conditions of more than 12,000 individuals and, this year, the findings are a bit of a mixed bag. On the plus side, 74 percent of respondents described themselves as either “doing ok” or “living comfortably” financially, up more than 10 percentage points from 2013. That’s good news. However, more than a quarter of respondents said they are either “just getting by” or “finding it hard to get by,” and this percentage was more than two-thirds for African Americans and Hispanics. More than a quarter of respondents reported going without some form of medical care in 2017 because they couldn’t afford it; for those with incomes less than $40,000, 39 percent went without some medical treatment. That a quarter of all surveyed are so economically insecure should be cause for alarm. When large proportions of people cannot handle the cost of medical treatment or other emergencies, we know we cannot rely on the workings of the economy to ensure a stable place in the middle class. Prosperity is elusive for far too many, and that remains especially true for African Americans and Latinos.

Despite the fact that a majority of respondents say they are ok with their current situation, the report found that not as many have grounds for confidence looking down the road. One-quarter of the non-retired have no retirement savings or pension at all; this includes one-quarter of those in their 50s and 60s. White non-retirees are 14 percentage points more likely to have any retirement savings than their African American counterparts and are 19 percentage points more likely to have retirement savings than their Hispanic counterparts. One in 10 African Americans and Hispanics lack a bank account, and an additional 3 in 10 have an account but also utilize other financial services such as check cashing. Of those who use alternative financial services, 22 percent use pawn shops or payday or car title lenders; we know the latter two keep people trapped in a cycle of debt.

Statistics like these make the work that we do to protect basic needs programs like SNAP/food stamps, housing assistance, Medicaid, and Social Security all the more important. When 4 in 10 Americans say they would struggle with an expense as low as $400, we know programs that support our low-income neighbors are critical in helping in times of need. When more than 10 percent of those who are not working said it’s because they can’t find work and 13 percent said it’s because they have child care or family responsibilities (these numbers are 36 percent and 22 percent, respectively, for part-time workers asked why they aren’t working more hours; other reasons given for not working or not working full time included medical limitations or disability, being retired, and being in school), we know that adding work harsh requirements to public benefits is not the right answer.

If members of Congress and the Trump Administration really want to ensure that every person in America is financially stable, they would increase investments in programs that assist low-income people rather than cut them. They would enforce regulations that protect low-income consumers rather than repeal them. They would ensure our children would have every possible opportunity rather than propose policies that would harm them. They would be on the side of average workers rather than on the side of the wealthy and corporations.

This post was originally published on the Coalition on Human Needs' blog, Voices for Human Needs. Receive similar articles in your inbox by subscribing today, and follow CHN on Facebook and Twitter.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!