Head Smacker: House Gives Millions of Dollars More to Wealthiest 5,000 Families

On April 16, the House voted (270-179) to give millions of dollars more to heirs of the wealthiest estates in America and to add the $269 billion cost of doing so to our growing deficit, all while continuing to claim they care about poverty reduction, inequality, and reducing our debt.

By repealing the estate tax, the House effectively gave $2 million to heirs of the wealthiest 5,400 estates in the U.S. – the only estates that are subjected to the tax. The richest of the rich – those inheriting the 318 estates in 2016 worth $50 million or more – will receive a tax break averaging $20 million each. As we noted in a blog last week, only estates worth more than $5.4 million for a single owner ever had to pay estate taxes. For a couple, their estate had to be worth more than nearly $11 million. This means only 0.2 percent of all estates in the country were ever subjected to this tax. Or, to look at it another way:

The Coalition on Human Needs is strongly against repealing this tax, which will increase inequality and take needed revenue away from programs that help low-income people. We sent a letter to Representatives urging them to vote no, and we joined many other national organizations in sending a similar group letter.

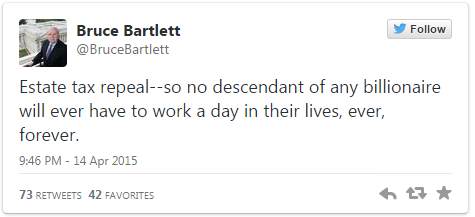

Repealing the estate tax is such a bad idea that even Bruce Bartlett, a self-proclaimed “lifelong conservative” who served in both the Reagan and George H.W. Bush Administrations, is against it:

Many who voted for the repeal claimed they did so to help small businesses and family farms, the icon of Americana. This is a Head Smacker, too, as only 20 small business and small farm estates nationwide owed any estate tax in 2013, and those 20 estates owed less than 5 percent of their value in tax, on average. For more Head Smacking facts, check out 10 Facts You Should Know About the Federal Estate Tax and this great piece debunking false claims about the estate tax.

The future of the estate tax repeal bill is uncertain as it heads to the Senate. What is certain is that we can’t let policy makers get away this kind of absurdity. The wealthiest one-tenth of one percent already own 22 percent of our nation’s wealth. The $269 billion the House spent on this move could have funded pre-school for all four year olds, expanded and protected tax credits for 50 million low-income families, and supported many other human needs programs. We need Members of Congress to know that these kinds of actions speak volumes about who they’re protecting – the top 0.2 percent.

Click here to thank your Representative if he or she voted against repealing the estate tax or express your dismay if he or she voted in favor. Our action alert will provide you with sample text to get you started depending on how your Rep. voted. Please be encouraged to edit and personalize the text. You can also tell Speaker Boehner you oppose the House's action by sharing your thoughts on his website.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!