Tax Day Question: Can I Make Enough to Pay for Childcare?

When our daughter was born, my husband had just started his second year at a law firm and I had just been laid off from a part-time job. We sat down together to decide whether I should look for a new job or not. The question we asked ourselves was, “Could I make enough to pay for childcare?” If not, we reasoned, it would make sense for me to take care of our baby myself.

Little did we know that the question had nothing to do with the cost of childcare and everything to do with tax policy.

You see, before World War II, the United States used an income tax system of separate filing for married couples in which tax rates applied to each spouse’s income separately.* As Ed McCaffery, author of Taxing Women, explains in his book, when the war ended and the costs of war went away, Congress saw an opportunity to reduce taxes. They did it by eliminating separate filing and replacing it with mandatory joint filing for couples. At the time, Congress also had an interest in wanting families to return to normal. In other words, they wanted mothers who had entered the workforce during the war to go back home. Joint filing would encourage them to do just that. As the legislative counsel of the treasury at the time remarked, “Wives need not continue to master the details of . . . business, but may turn . . . to the pursuit of homemaking.”

Joint filing introduced what McCaffery calls the “secondary earner bias.” The one who earns less, even today usually the woman, will be taxed more, which acts as a powerful but unseen disincentive for her to be employed.

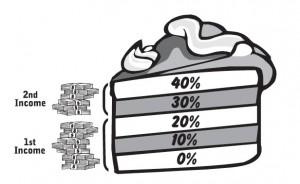

How does it work? Married couples filing jointly are required to combine their incomes, no matter who earns what. However, the money doesn’t go into a common pool that is all taxed at the same rate. As my friend Kimberly Tso explains in her blog post at The Two Penny Project, “Our federal income tax system uses graduated marginal rates. This is how to think about it: Imagine each dollar that you earn is stacked one on top of the other. Next, picture a large wedding cake next to the stack of dollar bills. Each tier of the cake (called the tax bracket) has a corresponding tax rate that increases as you go up each tier. …You only incur the higher tax rate if your stack of bills reaches that layer.” (See picture for example using hypothetical tax rates.) The policy goal of taxing the top layers more is for individuals who earn more to pay a higher percentage of their income in taxes compared to those who earn less.

For a couple, combining the incomes into one stack and then applying increasing rates to each layer has another effect—the secondary earner bias. When my husband and I faced the question of whether I should find a job or not, we thought of his job and his income as primary because he already had a job and he earned more. So we also thought of his income as first in the stack—where it would get taxed at lower rates.

My income was secondary. We could decide whether it was needed or not. We thought of childcare as coming out of my income because we wouldn’t need childcare unless I was employed. The question became, “Can I make enough to pay for childcare?” But the answer had everything to do with taxes. Given the combination of joint filing and graduated marginal rates, the very first dollar I earned would be in a layer on top of his income where it would get taxed at a higher rate. Subtracting childcare and that higher tax rate from my potential income, there wasn’t much left. Working for pay didn’t pay much. So we decided I wouldn’t, because we could afford for me not to. The World War II era policy worked on us precisely as it was intended.

McCaffery also explains that the secondary-earner bias influences mothers’ decisions and family finances at all income levels, not just for those who can afford not to be employed. Middle-income families who have a harder time giving up even the small contribution of a second earner face a “full-time or nothing” decision about employment. Working part-time just isn’t worth it. At even lower income levels, the wages of a second earner can put a couple over a threshold that means the loss of a tax break called the earned income tax credit. At these income levels—typically a household income of less than $40,000 a year—the secondary earner bias is even greater. If these parents work more, or if they aren’t yet married and then get married, they see little gain and may even lose money.

A policy decision made over 60 years ago continues to work as designed, invisibly, to discourage women from employment and lead mothers to ask themselves, “Can I make enough to pay for childcare?” Today there are those who claim women are “opting out” of the workforce or earning less because they “choose” to leave jobs to care for family but those people conveniently ignore – or are ignorant of - the fact that our tax policy was intentionally designed to push women out of the workforce.

Awareness of the secondary-earner bias can help families shift their thinking. My husband and I now talk about childcare as a family expense, not as his or hers. However, there’s no escaping the rational economic calculation unless we change the policy itself. Most advanced countries today mandate separate filing like the United States did before 1948. There are multiple policy options available to decrease the impact of the secondary earner bias. It doesn’t have to be this way, and it’s time to put more money in the pockets of families that need it and stop allowing this antiquated policy to push women out of the workforce.

Kristin Maschka is the author of the LA Times Bestseller, This is Not How I Thought It Would Be: Remodeling Motherhood to Get the Lives We Want Today. This piece is cross-posted from her blog.

More Resources:

- Women’s eNews “Tax Law Pushes 'Secondary Earners' to Drop Out,” Kristin Maschka

- Taxing Women, Ed McCaffery

- National Center for Policy Analysis: Women and Taxes, Ed McCaffery

* The pre-World War II separate filing shouldn't be confused with today’s “married, filing separately” category, which is used in rare circumstances, such as when one spouse wants to avoid the tax problems of the other.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!